Insurance Companies are requiring patients to pay more for less coverage

- Insurers Are Shifting More Costs To Patients

- Insurance Companies Are Using Discriminatory Practices To Drive Sick People From Their Plans

- Prescription Drugs Are Not Driving Premium Increases

- Higher Premiums Translate to Higher Profits

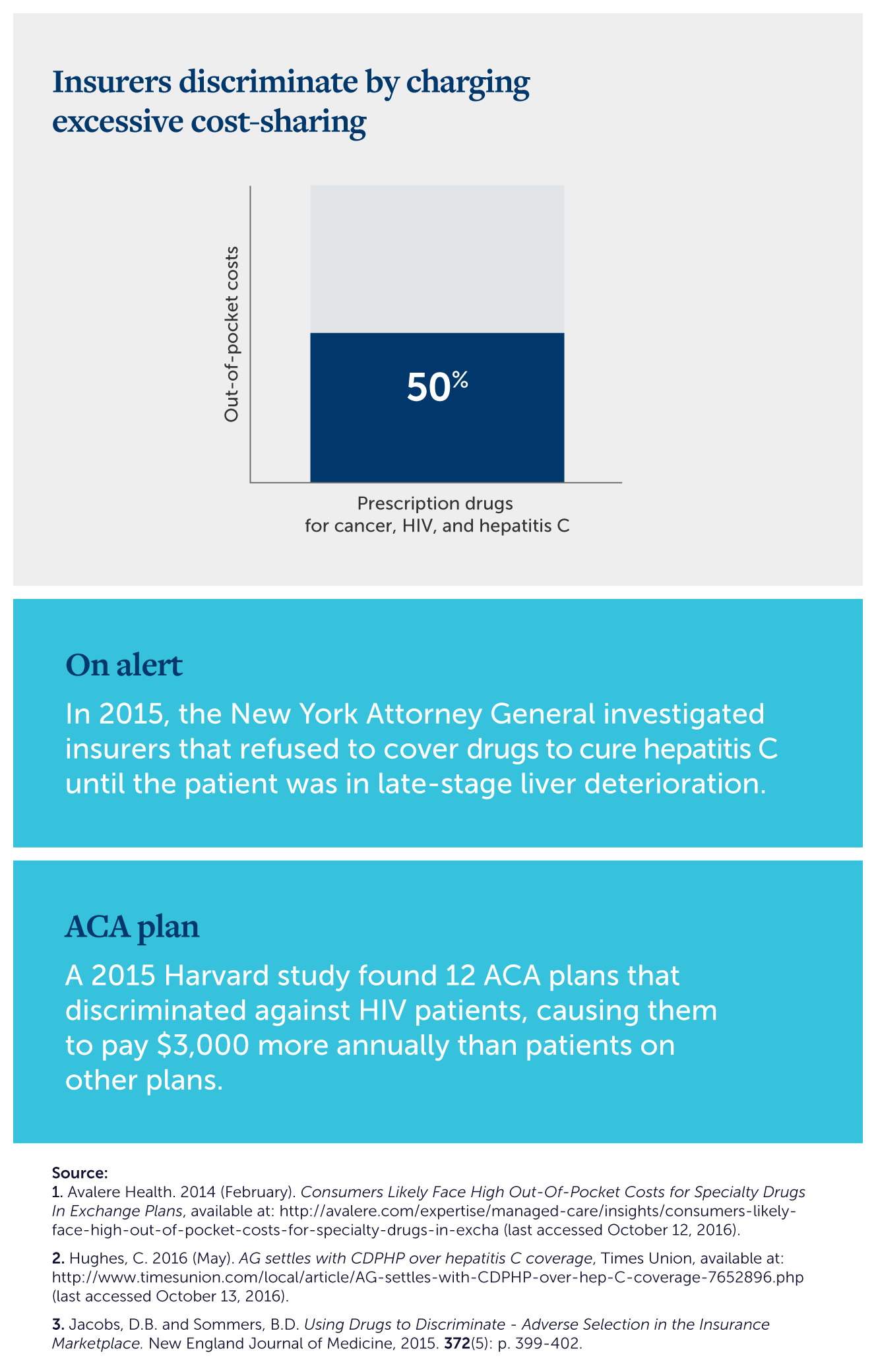

Insurance companies are using discriminatory practices to drive sick people from their plans

The Affordable Care Act (ACA) prevents insurers from discriminating against patients with pre-existing conditions. However, insurance companies have adopted a new practice that achieves the same results: using specialty drug tiers to charge excessive amounts out‑of‑pocket (even for normally low-cost drugs) as a way to keep sick patients off their plans.

A pair of Harvard studies analyzed this trend and its effects for consumers. They reported that insurers sought to make some medications “disproportionately expensive” and the practice would have a “discriminatory effect of discouraging individuals in need of specific medications from enrolling in these plans or of shifting the burden of the cost back to these enrollees.”

In New York and Florida, insurers were the subjects of lawsuits and state investigations after allegations of discrimination were uncovered.

Additional Reading & Resources

- New York AG investigation, 2016

Hughes, Claire. 2016. “AG settles with CDPHP over hepatitis C coverage.” Times Union. May 18.2016. http://www.timesunion.com/local/article/AG-settles-with-CDPHP-over-hep-C-coverage-7652896.php. - Up to 50% out of-pocket costs for specialty drugs, 2014

Avalere Health. 2014. Consumers Likely Face High Out-Of-Pocket Costs for Specialty Drugs In Exchange Plans. February 20, 2014. http://avalere.com/expertise/managed-care/insights/consumers-likely-face-high-out-of-pocket-costs-for-specialty-drugs-in-excha.

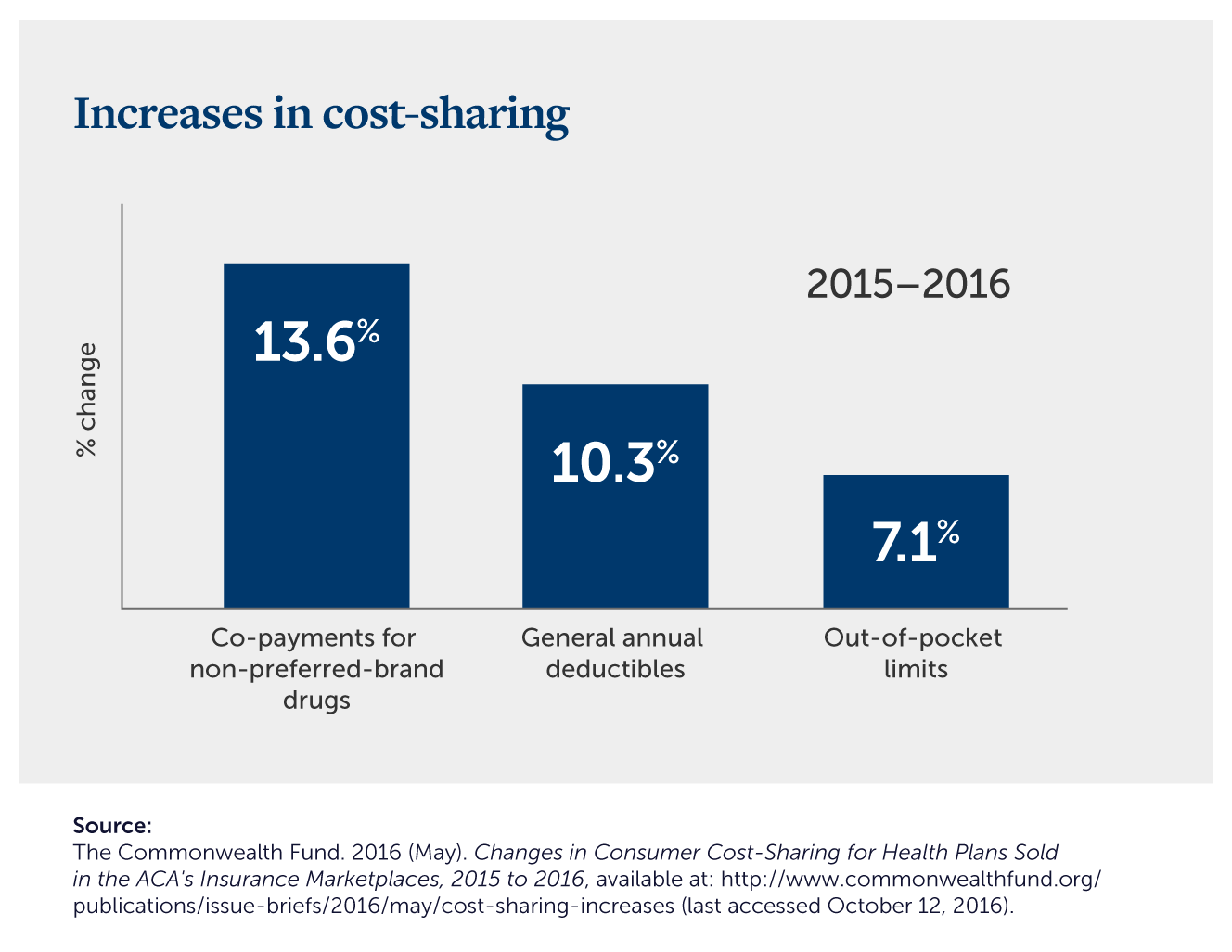

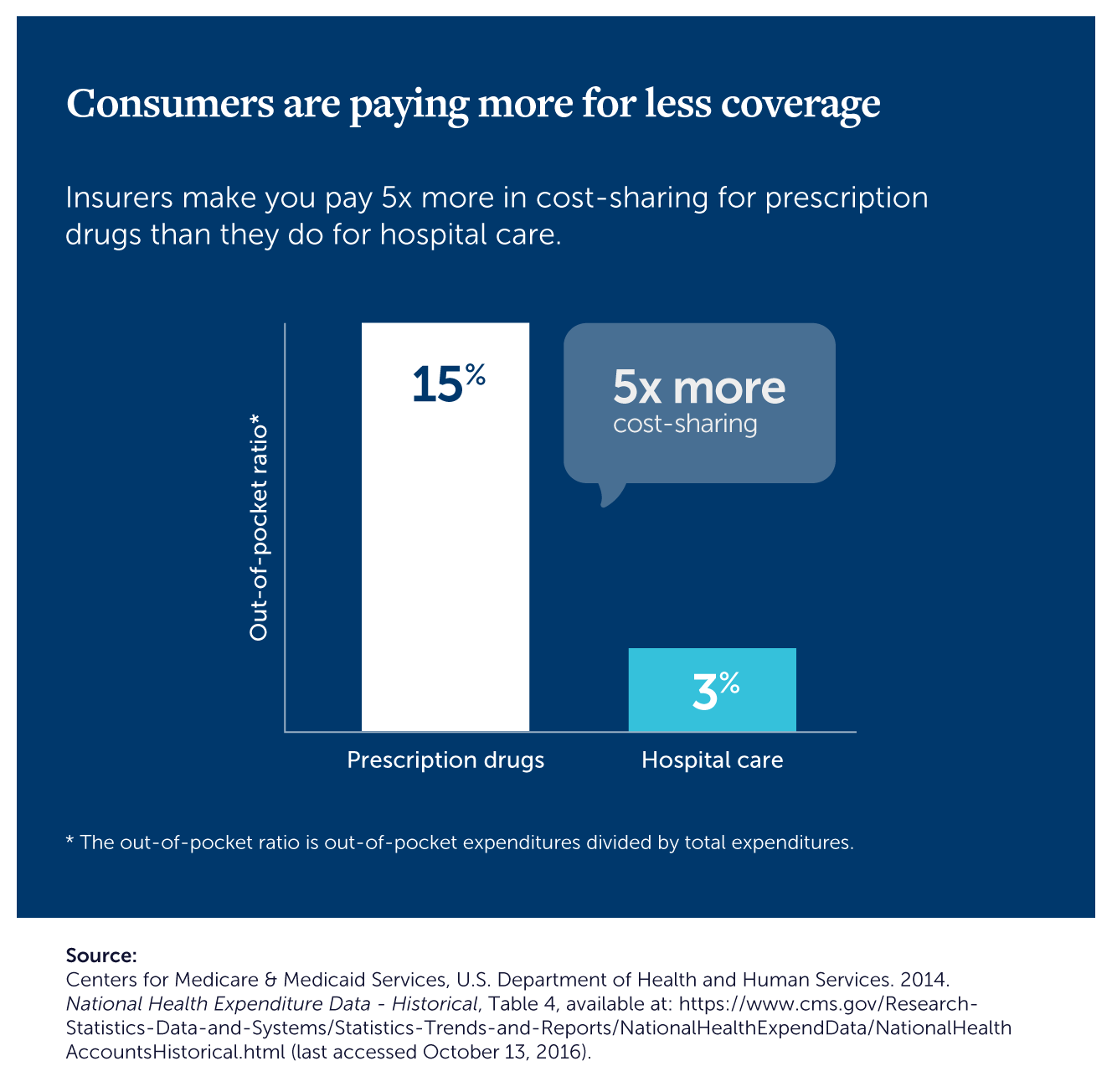

Insurers Are Shifting More Costs To Patients

Additional Reading & Resources

- Out-of-pocket costs for prescription drugs vs. hospital care, 2014

U.S. Department of Health and Human Services, Centers for Medicare & Medicaid Services. National Health Expenditures Data. 2014. Table 4. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.html. - Increases in cost-sharing, 2016

Gabel, J. et al. 2016. Changes in Consumer Cost-Sharing for Health Plans Sold in the ACA’s Insurance Marketplaces, 2015 to 2016. The Commonwealth Fund. May 2016. http://www.commonwealthfund.org/publications/issue-briefs/2016/may/cost-sharing-increases.

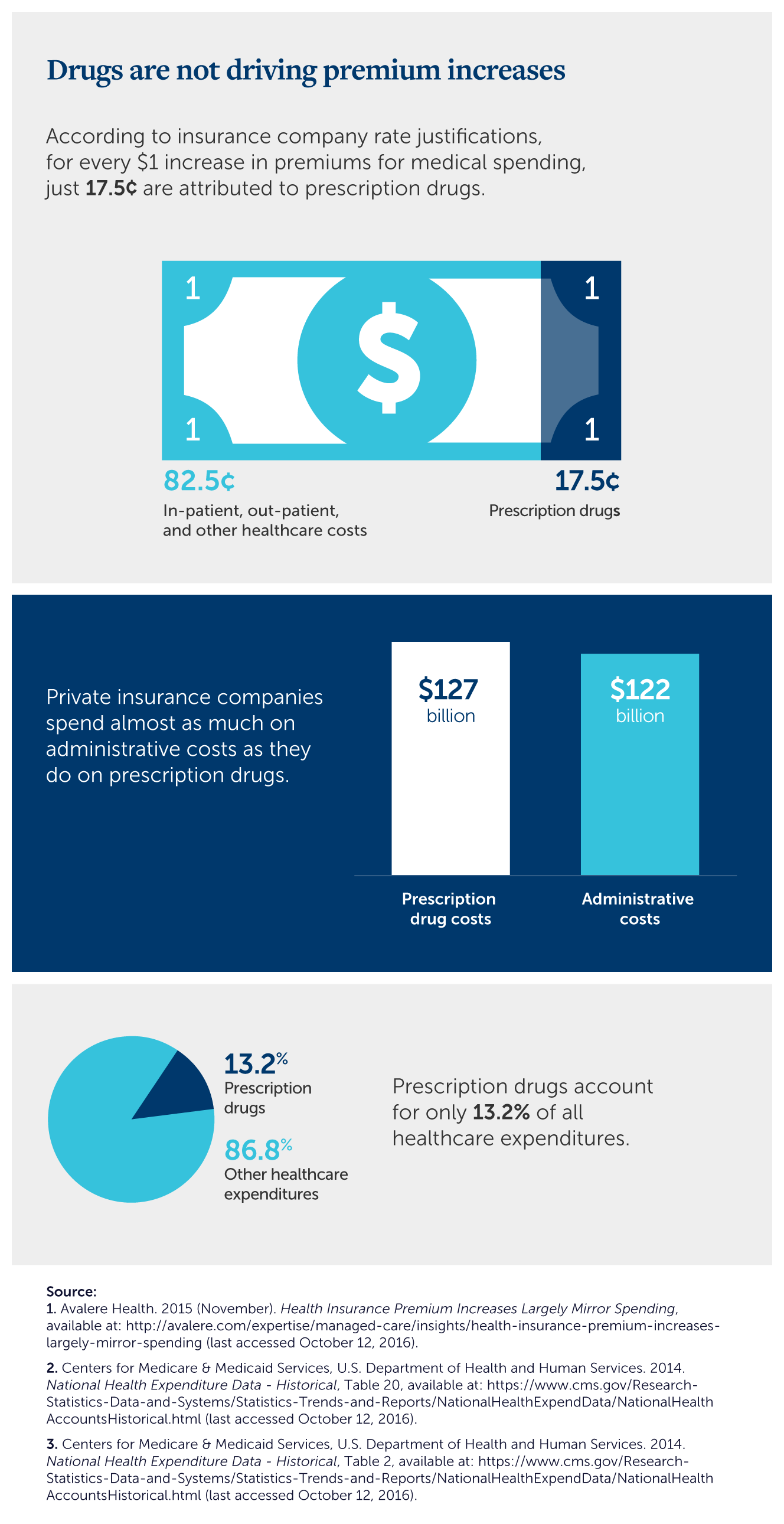

Prescription drugs are not driving premium increases

Looking at insurance companies’ own data for health plans sold in the ACA marketplace in 2016, for every $1 increase in premiums for medical spending, just 17.5 cents are caused by prescription drugs. In terms of overall health expenditures, prescription drugs account for only 14%.

Insurers won’t tell you that drugs are a tiny fraction of their own costs. In fact, private insurance companies spend almost as much on administrative costs as they do on prescription drugs.

Additional Reading & Resources

- Growth in health care costs (82.5 cents vs. 17.5 cents), 2016 Premium increase justification

Avalere Health. 2015. Health Insurance Premium Increases Largely Mirror Spending. November 16, 2015. http://avalere.com/expertise/managed-care/insights/health-insurance-premium-increases-largely-mirror-spending. - Prescription drugs make up 13.6% of national expenditures, 2014

BIO Drug Expenditures Tables. 2014. BIO derived from: U.S. Department of Health and Human Services, Centers for Medicare & Medicaid Services. National Health Expenditures Data. NHE 2014 Table 2. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.html and Altarum Institute Analysis. - Insurance administrative costs are almost the same as drug costs, 2014

U.S. Department of Health and Human Services, Centers for Medicare & Medicaid Services. National Health Expenditures Data. NHE 2014 Table 20. https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.html.

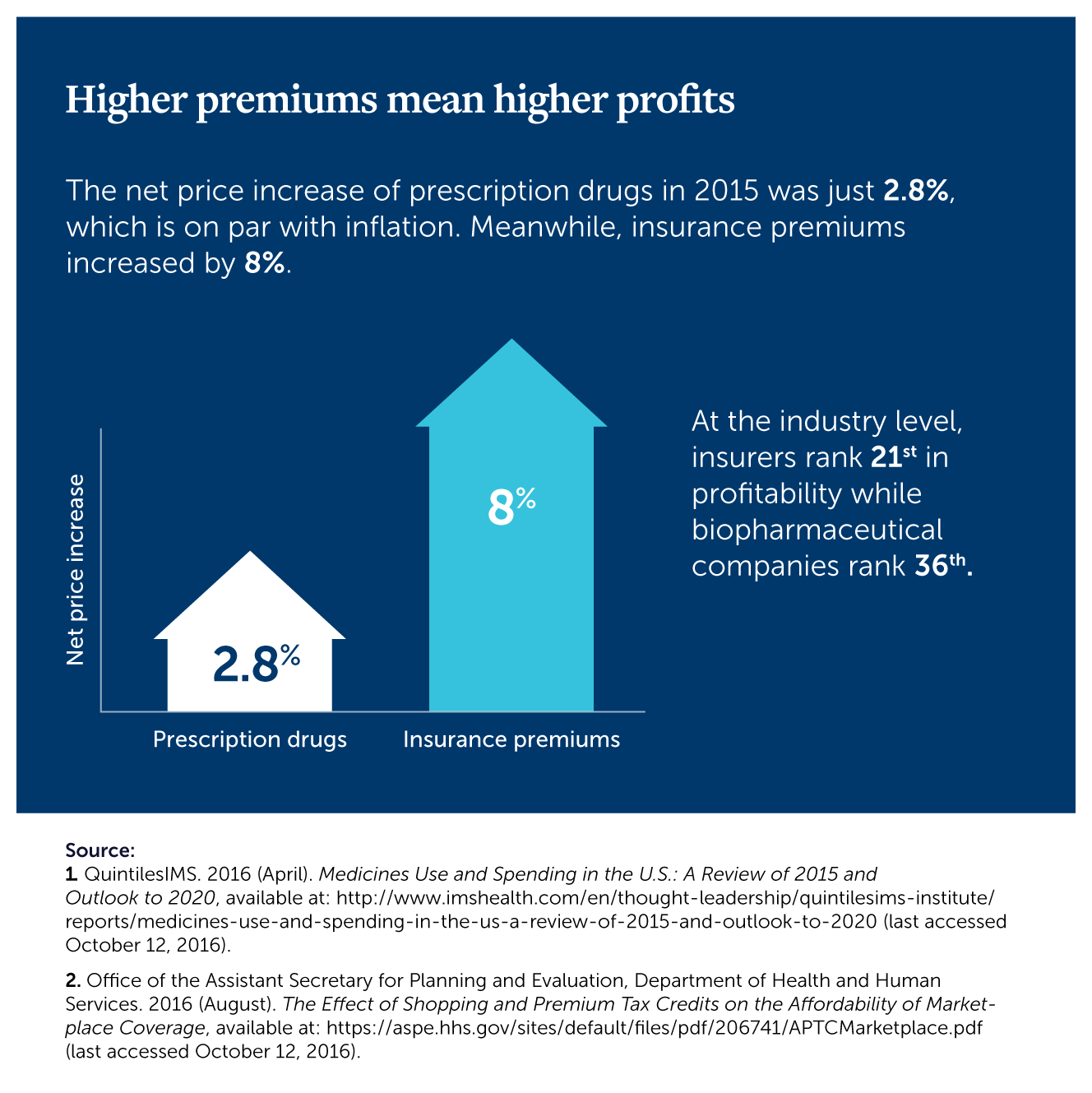

Higher premiums translate to higher profits for insurance companies

Since the passage of the ACA, the insurance industry is more profitable than ever. Two of the nation’s largest insurers—United Health and Humana—saw their net incomes double since 2008. While the stock market performance of the five largest insurers (by market capitalization) far outpaced the five largest pharmaceutical companies from March 2010 through March 2016.

Additional Reading & Resources

- 2.8% increase in drug prices, 2015

IMS Institute for Healthcare Informatics. 2016. IMS Releases 2016 Report on Prescription Drug Spending – Net Price Growth 2.8% in 2015. May 2016. http://www.policymed.com/2016/05/ims-releases-2016-report-on-prescription-drug-spending-net-price-growth-28-in-2015.html. - 6% increase in premiums, 2016

Gabel, J. et al. 2016. Changes in Consumer Cost-Sharing for Health Plans Sold in the ACA’s Insurance Marketplaces, 2015 to 2016. The Commonwealth Fund. May 2016. http://www.commonwealthfund.org/publications/issue-briefs/2016/may/cost-sharing-increases. - Profitability rankings, 2016

Factset, BIO Industry Analysis, June 2016